Coal prices at record highs, but investors wary [BlackDiamond]

NEW YORK, Oct 17 (Reuters) - With coal prices at historic highs, mining companies should be reaping record profits, but rail delivery problems, soaring energy costs and the effects of Hurricane Katrina are holding the industry in check.

Although Wall Street expects the Big Four U.S. coal producers to report healthy third-quarter earnings, some investors are wary of an industry that has so dramatically turned around from two years ago, when it was swimming in red ink.

Massey Energy Co. already has warned that profit will miss analysts' estimates for the quarter on lower shipping volumes and higher costs, in part due to rising fuel prices in the wake of Katrina.

While coal is poised to benefit from its image as a relatively cheap alternative to oil and gas, the miners also need those costly fuels to power their operations.

Indeed, a report by Standard & Poor's Ratings Services says the rise in spot coal prices over the past 18 months has generally not translated into positive outlooks for the producers.

"Amid a robust domestic economy and elevated oil and natural gas prices, it's no surprise that coal prices are high," said S&P analyst Dominick D'Ascoli. "Add the strong demand from Asia and low electric utility inventories, and one can see that these are good times for U.S. coal producers."

But S&P's outlook for most U.S. coal producers' credit quality is stable, rather than positive. Among the mitigating factors are increased debt, weak liquidity, business-risk issues, escalating costs, and mine disruptions, the report said.

In the first two weeks of the new quarter, the index comprising the four major coal company stocks is off about 4 percent after rising more than 45 percent in the third quarter.

But prices of the fuel itself continue to rise. On Friday, coal from the Powder River Basin in Montana and Wyoming was trading at more than $15 per ton -- double what it was a year ago. And eastern coal, from the Appalachia region, was at near-peak levels of $56 to $58 per ton.

GOOD NEWS

"I expect steam coal prices to stay at the current level for four to five years," said Nick Carter, president and chief operating officer of Natural Resource Partners referring to coal for electricity generation.

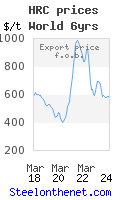

The price line for metallurgical coal, which is used in steel production, looks even longer, he told a recent American Coal Council conference.

So why is the stock market skittish? Westminster Securities analyst Richard Price points to macroeconomic worries like uncertainty over inflation and interest rates, as well as production costs and supply cuts.

The market is pondering whether recent high coal prices represent a new plateau in a cyclical industry, he said.

"I think it probably is close to a new plateau," Price said. "I don't see metallurgical coal coming down."

Powder River Basin steam coal was high because deliveries are curtailed as a result of rail repair work following derailments earlier this year.

Meanwhile, Price said, power plant coal inventories are at historic lows -- "I have even heard of some below 10 days, which is unusually low."

But since most major utilities buy on long-term contracts, "it's the smaller utility buyers, like ones owned by municipalities, that are getting stuck with the high prices," Price said.

About 50 percent of U.S. electricity is generated in coal-fired power plants, he said.

Phil Saunders, a senior vice president of Atlanta-based energy company Southern Co. told industry newsletter Coal & Energy Price Report that concerns about natural gas shortages are putting pressure on coal stockpiles. "There are a lot of questions about whether we will be able to keep the lights on."

blogger@steelonthenet.com

Although Wall Street expects the Big Four U.S. coal producers to report healthy third-quarter earnings, some investors are wary of an industry that has so dramatically turned around from two years ago, when it was swimming in red ink.

Massey Energy Co. already has warned that profit will miss analysts' estimates for the quarter on lower shipping volumes and higher costs, in part due to rising fuel prices in the wake of Katrina.

While coal is poised to benefit from its image as a relatively cheap alternative to oil and gas, the miners also need those costly fuels to power their operations.

Indeed, a report by Standard & Poor's Ratings Services says the rise in spot coal prices over the past 18 months has generally not translated into positive outlooks for the producers.

"Amid a robust domestic economy and elevated oil and natural gas prices, it's no surprise that coal prices are high," said S&P analyst Dominick D'Ascoli. "Add the strong demand from Asia and low electric utility inventories, and one can see that these are good times for U.S. coal producers."

But S&P's outlook for most U.S. coal producers' credit quality is stable, rather than positive. Among the mitigating factors are increased debt, weak liquidity, business-risk issues, escalating costs, and mine disruptions, the report said.

In the first two weeks of the new quarter, the index comprising the four major coal company stocks is off about 4 percent after rising more than 45 percent in the third quarter.

But prices of the fuel itself continue to rise. On Friday, coal from the Powder River Basin in Montana and Wyoming was trading at more than $15 per ton -- double what it was a year ago. And eastern coal, from the Appalachia region, was at near-peak levels of $56 to $58 per ton.

GOOD NEWS

"I expect steam coal prices to stay at the current level for four to five years," said Nick Carter, president and chief operating officer of Natural Resource Partners referring to coal for electricity generation.

The price line for metallurgical coal, which is used in steel production, looks even longer, he told a recent American Coal Council conference.

So why is the stock market skittish? Westminster Securities analyst Richard Price points to macroeconomic worries like uncertainty over inflation and interest rates, as well as production costs and supply cuts.

The market is pondering whether recent high coal prices represent a new plateau in a cyclical industry, he said.

"I think it probably is close to a new plateau," Price said. "I don't see metallurgical coal coming down."

Powder River Basin steam coal was high because deliveries are curtailed as a result of rail repair work following derailments earlier this year.

Meanwhile, Price said, power plant coal inventories are at historic lows -- "I have even heard of some below 10 days, which is unusually low."

But since most major utilities buy on long-term contracts, "it's the smaller utility buyers, like ones owned by municipalities, that are getting stuck with the high prices," Price said.

About 50 percent of U.S. electricity is generated in coal-fired power plants, he said.

Phil Saunders, a senior vice president of Atlanta-based energy company Southern Co. told industry newsletter Coal & Energy Price Report that concerns about natural gas shortages are putting pressure on coal stockpiles. "There are a lot of questions about whether we will be able to keep the lights on."

blogger@steelonthenet.com

0 Comments:

Post a Comment

<< Home